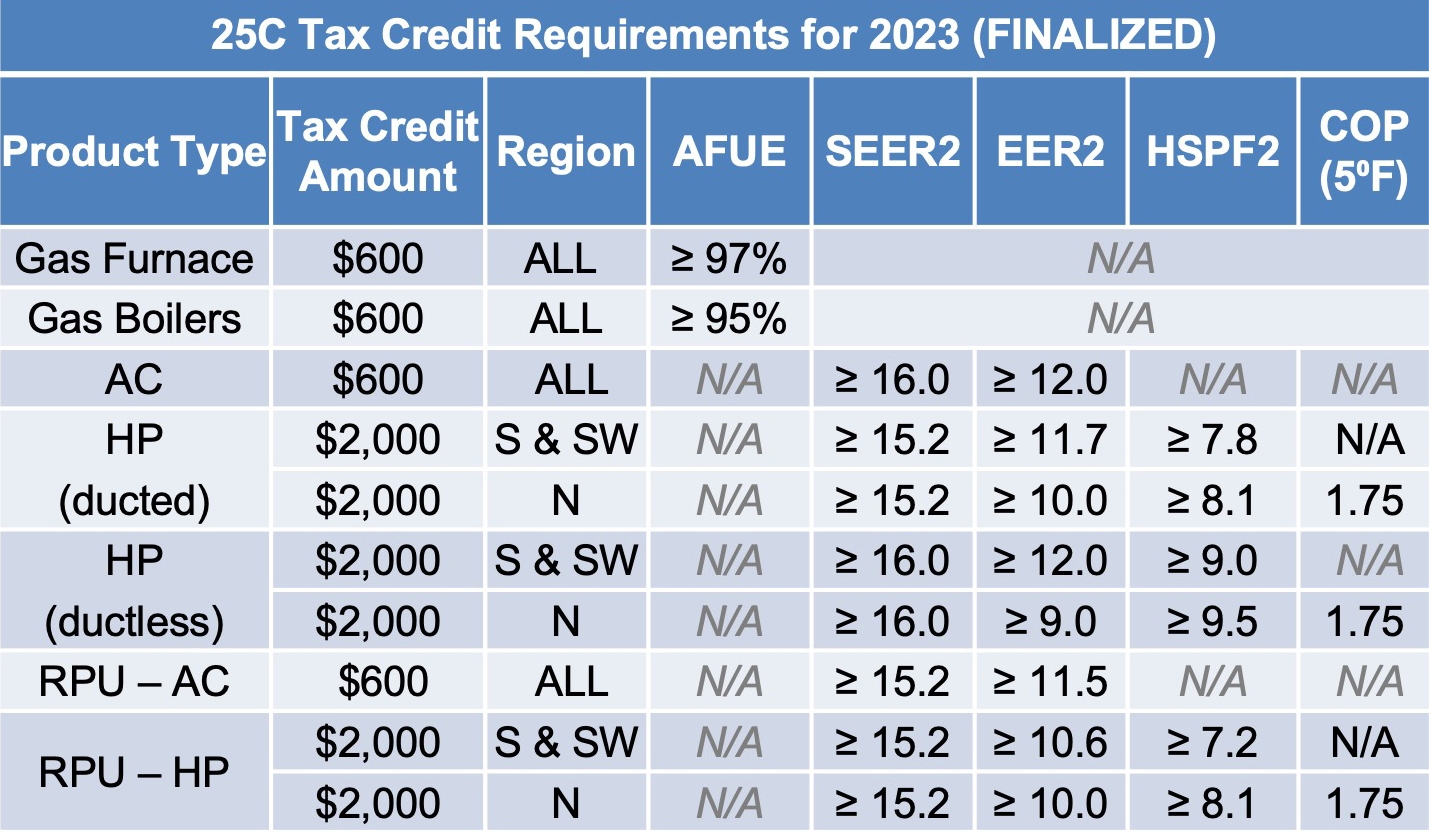

25c Tax Credit Requirements 2025. For example, if your heat pump is deployed in 2025, you can redeem your credit when you submit your taxes in 2025 for the 2025 tax season. Last month, the department of treasury and irs proposed regulations to implement product identification number (pin) requirements for taxpayers who use.

Taxpayers to claim the “energy efficient home. Once the home energy rebates are available, eligible rebate recipients may also claim a 25c tax credit for eligible products as applicable to the cost to the consumer after the.

25C Tax Credit JSP Heating and Plumbing, 31, 2025, no credit is allowed under section 25c. It provides that for property placed in service after dec.

IRA Tax Credits 25c Ideal Air Conditioning and Insulation, On august 4, 2025, the u.s. The credit you qualify for can very depending on.

IRA Webinar 2 Understanding the 25C Tax Credit for Contractors, Energy efficient home improvement credit text contains those laws in effect on april 30, 2025. 10 percent of the amount paid or incurred by the taxpayer for qualified energy efficiency improvements installed during such taxable year, and.

What is a taxcredit program? Children's Tuition Fund, Newly constructed homes are not. § 25c (a) (1) —.

25C Tax Credit Fact Sheet Building Performance Association, This tax credit is a. Last month, the department of treasury and irs proposed regulations to implement product identification number (pin) requirements for taxpayers who use.

25c tax credit How to get it and what’s eligible Sealed, A nonrefundable tax credit allows taxpayers to lower their tax liability to zero, but not below zero. The ira added the pin requirement under section 25c(h).

25C Federal Tax Credit Al Terry Plumbing, Heating, HVAC & More!, For example, if your heat pump is deployed in 2025, you can redeem your credit when you submit your taxes in 2025 for the 2025 tax season. If you invest in renewable energy.

Expanding the 25C Tax Credit Is a NoBrainer for Climate Action, On august 4, 2025, the u.s. Provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency.

Tax Credit (25C) HVAC Tax Credits, Energy efficient home improvement credit text contains those laws in effect on april 30, 2025. About form 5695, residential energy credits.